With retirement planning far down the list of priorities among youths the EPF has consistently stated that a majority of Malaysians do not have enough money in their EPF accounts to last them for long. Principal Retirement Services.

Structure Of Prs Private Pension Administrator Malaysia Ppa

Affin Hwang Asset Management Berhad.

. In Malaysia EPF interest rates operate on the high side with the. Permanent departure from Malaysia. This was shown in my article on Retirement Planning in Malaysia.

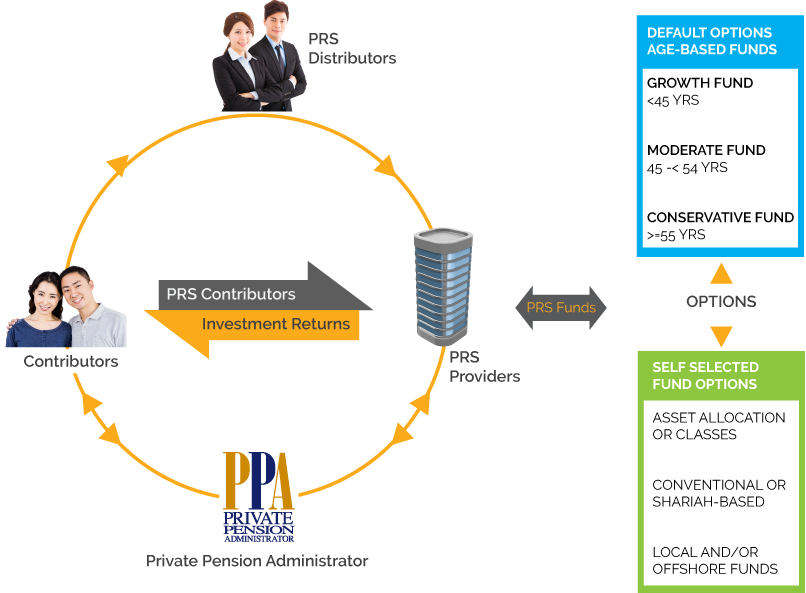

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. GTL insurance is an insurance plan designed to provide insurance coverage to Members of Manulife PRS Asia-Pacific REIT Fund. Housing purposes From sub-account B Healthcare purposes From sub-account B Permanent Total Disablement PTD Serious Disease SD Mental Disability MD From both sub-account A and B 2The age group may.

In the end you will obtain a total of 385 pa. Save invest and retire wellPrivate Retirement Schemes Quick Overview Private Retirement Schemes PRS were introduced in 2012 as a voluntary long-term investment scheme to help accumulate funds for retirement. There is actually an additional step called Invest that allows you to earn another 10 pa.

PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. In Malaysia we already have a pretty good public retirement savings plan Employees Provident Fund EPF. It provides coverage for Death and Total Permanent Disability for the Members up to a maximum of.

Established under the Capital Markets and Services Act CMSA 2007 PRS is regulated and supervised by the Securities Commission Malaysia SC to ensure robust regulation and supervision of the PRS. The Private Retirement Schemes or PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. A Quick Introduction to PRS Providers.

The sheer amount of funds that we should have by the time we retire can be an overwhelming sum. Terms and conditions apply. Coverage of up to RM100000 Group Term Life GTL insurance with Total and Permanent Disability.

Find out what are the best Malaysian Private Retirement Schemes PRS to invest in in 20202021. Currently the tax relief period is 10 years from 2012 to 2021. As for fees PRS funds impose these charges.

Switching fee transfer fee and redemption charge. Manulife PRS Asia-Pacific REIT Fund. Click here to read the full Terms Conditions.

Lets take a look at why you ought to consider saving for retirement with this scheme. You can make pre-retirement withdrawal for the following purposes without 8 tax penalty4. In 2014 and again in 2017 the EPF found that.

Sales charge to pay for marketing and servicing services up to 3 per annum this is the one you want to drastically reduce Annual management fee to pay for investment management services Up to 18 per annum. PRS offers a choice of retirement funds from which individuals may choose to invest in based on their own retirement needs goals and risk appetite. Each PRS offers a choice of retirement funds from.

You are allowed to claim up to RM3000 for PRS contributions each year for a total of 10 years. You can do so by investing at least RM1000 in RHB financial products such as non-EPF investment private retirement schemes PRS and unit trust funds. The Philippines Thailand Malaysia Singapore Indonesia India Vietnam and Cambodia are some countries where one can find a safe retirement haven friendly people lower cost of living and a lifestyle comparable to that in the developed economies.

The most obvious reason to invest in PRS Malaysia is because of the RM3000 tax relief that you can enjoy in each year of assessment. If you are eligible to pay taxes you may be interested in the fact that contributions made to your PRS account can be claimed for taxes. KUALA LUMPUR Dec 10 Malaysians cannot afford to retire with just their EPF savings alone.

Tax savings from RM3000 tax incentive. Alternatively you can call our Customer Care Centre at 603 7723 7260 or you can leave your detail here. The Private Retirement Schemes are offered by PRS Providers who are approved by the Securities Commission Malaysia.

Enjoy additional personal tax relief You can get up to RM3000 personal tax relief annually on top of the RM6000 annual tax relief for EPF contribution and life insurance premiums. With low air fares it is also possible to travel to these countries affordable. For public employees there is the Kumpulan Wang Persaraan Diperbadankan or KWAP Malaysia which focuses on managing retirement and pension funds for civil servants.

RM3000 Tax Relief. The eight 8 available PRS Providers are.

Best Private Retirement Schemes Malaysia 2022 Imoney My

A Guide To The Private Retirement Scheme Prs

Which Prs Funds To Invest In 2020 2021 Mypf My

A Complete Guide To Epf Members Investment Scheme Best I Invest Fund Youtube In 2022 Investing Financial Literacy Fund

Structure Of Prs Private Pension Administrator Malaysia Ppa

Diversify Your Retirement Nest Egg

Structure Of Prs Private Pension Administrator Malaysia Ppa

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Private Retirement Scheme Principal Asset Management

Structure Of Prs Private Pension Administrator Malaysia Ppa

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

What S The Difference Of Private Retirement Scheme And Deferred Annuity Plan Kclau Com

Beginner S Guide To Private Retirement Schemes Prs In Malaysia

I Save In Prs Private Pension Administrator Malaysia Ppa

3 Reasons Why You Should Invest In Prs Private Retirement Scheme Malaysia Retirement Youtube

Prs For Self Employed Private Pension Administrator Malaysia Ppa

Cover Story Is Prs Outperforming Epf The Edge Markets